STRUCTURE

- Structure Finance offers innovative financial products with a simplified user experience.

- Our products are suitable for both novice traders and seasoned market experts.

Structure Finance is a financial trading platform built on Ethereum (ETH) and the Binance Smart Chain (BSC) with Layer-2 Scaling. We chose ETH and BSC for their compatibility with other DeFi protocols. Layer-2 protocols provide improved security and faster, more efficient transactions, for a better user trading experience.

Structure is a decentralized financial (De-Fi) platform. Unlike traditional financial applications, our De-Fi protocols are permissionless and open-source. Structure Finance supports major DeFi protocols for user-created applications.

Structure Finance offers structured products like DNT, LST and PDM, to give DeFi traders more user-friendly options.

Structure Finance plans to incorporate a Decentralized Oracle system for its operations.

Initially, we will collaborate with decentralized Oracle service providers to source the external price data needed for their structured products.

As the substrate ecosystem evolves, we intend to transition to an off-chain worker's module to fetch external data.

Structure aims to expand its compatibility by supporting various DeFi protocols, enabling us to directly obtain price data from platforms like Uniswap.

Oracle

Oracle

Decentralized Oracle

Initially, Structure will integrate with decentralized oracle service providers to get external price data for the structured products.

Offchain Workers

As Substrate ecosystem is more mature, Structure will use offchain workers module for obtaining external data.

Other Protocols

Structure will also support other DeFi protocols and receive price data directly from those platforms such as Uniswap.

User Incentives

To encourage users to deposit assets and incentivize a positive feedback loop, there will be token incentives paid out in STF. It is important for the platform to have initial liquidity to enable the option products to have accurate pricing and optimum profitability.

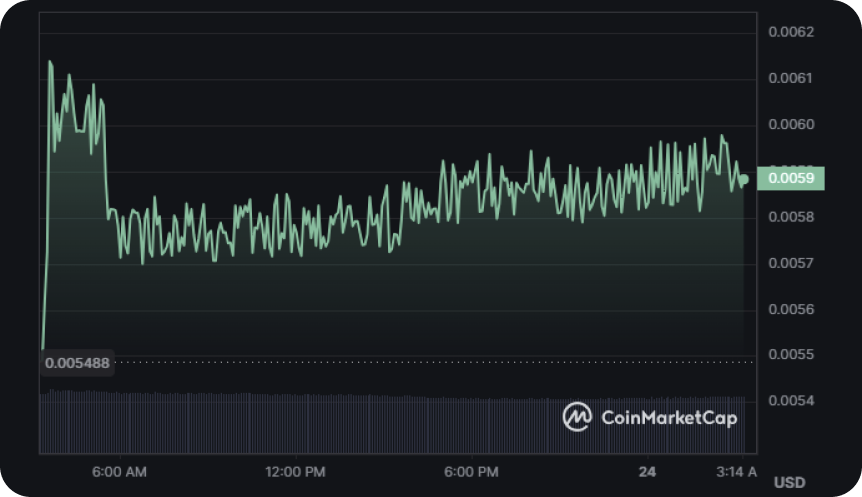

Platform Currency

COMING SOON

STF is the default currency for the STRUCTURE platform. Users can use STF to pay for transaction fees and also to purchase option products. Transaction fees will be collected into a reserve fund, and the use of this fund will be decided upon via decentralized governance.

Governance

COMING SOON

STF will function as a governance token for the STRUCTURE platform. STF holders will collectively propose and vote on which assets to support, which protocols to integrate, fee ratios, use of reserve funds, and more.

Community